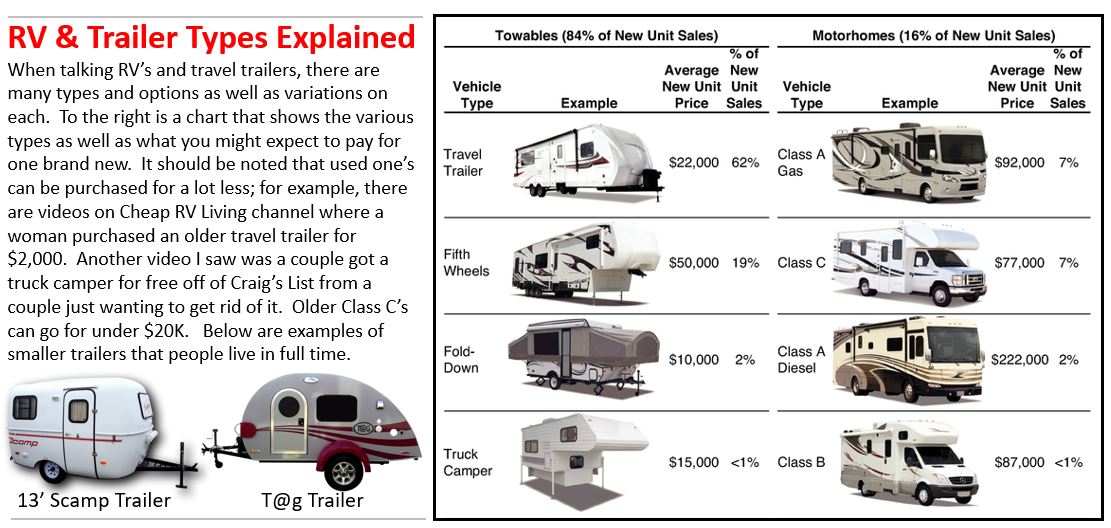

Below are some selections of YouTube videos by type of mobile solution. This is to save time of searching for specific things if you just want to get an idea of how others

are living life in different situations. Or you may find that living in a car definately does not appeal to you, or a camper, but a Class B or C would be ideal (personally,

I would prefer a Class C but that is more money than a trailer). So this list will give you a good summary of the different solutions to mobile living. Bob Wells from

Cheap RV Living also did an interview panel with some other nomads who had different rigs they live in, along with detailed information on the different options, so I'm

including the link here to How to Choose Which Type of RV is Best for You? The other thing you may

want to look at before even considering buying an RV, is looking at Don't Buy An RV! - Lehto's Law Ep. 45

where he talks about "why you shouldn't buy an RV - or what you should know before you do. Recreation Vehicles are very different from cars when it comes to how the law

protects you." Steve Lehto followed up with another video a year later, What You Need to Know Before You Buy an RV - Lehto's Law Ep. 3.19 where

he states "I have warned of the problems that come with RV ownership but I know many people are intent on buying them anyway. In that case, here is what you need to know

and what you can do BEFORE you buy an RV to protect yourself.".

Towing One of the aspects of living mobile is having an adequate tow vehicle.

If you have a car, jeep or small SUV, you will be limited on what type of trailer you can legally and safely tow. There are tow guides

available for the past several years that show vehicles tow weight limits. One of the best is

Trailer Life Towing Guides that provides, by year, a guide to

all kinds of cars, vans, SUVs, trucks, etc. and their weight limits. The files provided are PDF, such as the

2020 Tow Guide. You can pick the year

for the vehicle you have, or you can simply Google your car year, make and model followed by the words "towing capacity" and it will show you the maximum weight

your vehicle can tow. AutoGuide.com provides a video on the very basics of How to Tow a Trailer.

However, one of the better videos is by Smart Drive Test YouTube channel on

How to Tow a Trailer Correctly and Safely.

One of the reasons this is

so important is you can end up buying a trailer that you think your vehicle can tow and find out later that it cannot, or it can tow it as dry weight (where

the trailer is empty) but not after you add your stuff into the trailer, such as water, food, clothes, etc. That's what happened to Tinyhouse Prepper

(his channel mentioned above) where he bought a truck, had to replace the motor in it soon after, and then realized it would not tow the trailer they had

purchased. They shared their experience with their viewers in We'll Get There...Eventually!

If you want a bigger trailer, there are vendors who sell lightweight travel trailers that are big, but often at the expense of durability. The other day

I found a brand new travel trailer that had a great floorplan and was nice inside and it was lightweight; however, I could press into the walls and see they were very

thin and the construction seemed to be stapled. The sticker price was $16,888. I researched later and found it was an Ultra Lightweight Travel Trailer;

it was the Sportsmen Classic 181BH.

It was a 20' 6" travel trailer with a dry weight of 2,840 lbs. I then went to another dealer and they had a

Lance Travel Trailer 1685 that had

hard, sturdy walls (the salesman hit it with his hand several times), the bathroom door was hard wood, the furnishings were much nicer and real wood.

It's price was $40,000. It measured 21' feet in length with a dry weight of 3,980 lbs, over 1,000 lbs difference. You can also specify the 4 seasons package

in case you plan on doing any camping (or living) in cold climates. The cost of the Lance is over twice that of the Sportsmen, but they really serve two different

purposes and target different consumers. If someone was going to take a travel trailer out once in awhile in the summer and didn't have a heavy duty vehicle to tow with,

the Sportsmen might be a great alternative to save money and still hit the road (a great example is the Jeep Grand Cherokee that has a maximum tow capacity of

3,500 lbs - it can tow the Sportsmen but not the Lance). Whereas a consumer who can spend $40K on a trailer who may use it more or

in fact may live in it (like the family of 5 above living in a Lance Travel Trailer above), the additional cost may be well worth it. Just be careful when

buying a travel trailer, some are so poorly made that they leak and rot and have problems almost immediately. To see one first hand, view the video

How Bad It's Made - Travel Trailers.

|

Above you read the word minimalism several times. One of the important aspects of Living Life Differently, in a way as mentioned above,

but also for anyone regardless of circumstance, is to live frugally and budget wisely. There is a wealth of information on the internet

about personal finance (budgeting, spending, saving, retirement, etc.) as well as minimalism, so much so that it becomes difficult to decide

which information is valuable and which is not. It can be overwhelming watching and listening to all the prevailing opinions and the latest

rage over a new way to budget, a new way to invest or new investment options, the latest fad on cutting expenses, etc. This is one of the things

they don't teach in school but should, although most people don't ever learn the basics of these values. It may not seem obvious, but minimalism

and budgeting actually go hand in hand; minimalism at it's core is having very little while budgeting is reducing your spending as much as it is

focused on saving money. You can reduce your spending and not collect a lot of useless junk that may seem important at the time but later on you

end up storing in some closet or shed, or worse goes unused and is given away or thrown in the trash.

According to Trading Economics (based on the latest

data from the U.S. Bureau of Economic Analysis), "Household Saving Rate in the United States increased to 3.40 percent in February from 3.20

percent in January of 2018. Personal Savings in the United States averaged 8.26 percent from 1959 until 2018, reaching an all time high of 17

percent in May of 1975 and a record low of 1.90 percent in July of 2005." This means for every $100 in net (after-tax) income most Americans

earn, about $3.40 is being saved for retirement, emergency expenses, and rainy-day savings. The typical American family spends just over 61%

on housing, transportation and food. The remaining expenses are things like healthcare, entertainment, insurance, clothes, services, contributions

and other miscellaneous items. The most savings can come from the largest three above, which means if you can reduce your housing cost (which is

why many are opting for tiny or RV living), transportation by driving older vehicles that are paid off and keeping the food bill managed (food was

just over 10% of net income), a tremendous amount of savings can be realized.

- What a Well-off Couple Learned from Cutting Consumer Habits:

PBS News Hour (03/2018)

This is a news report of an affluent couple who decided they wanted to retire early so for a short time they saved the majority of their income

by living frugally. They now are in their 30's and not working any longer having reached financial independence by living smarter. The husband

does now work at home for a small non-profit in order to provide insurance for the family. The description says about this report,

"A software engineer and professional fundraiser in Boston decided four years ago to purge some of their consumerist habits to save more than

70 percent of their salaries. The result was a big move to rural Vermont and the release this month of the book,

'Meet the Frugalwoods: Achieving Financial Independence Through Simple Living.' NewsHour Weekend's Christopher Booker reports."

- Downsizing - A Minimalist Outlook on Stuff - RV Living in Canada:

Canadian RV Life (06/2016)

Couple downsizes 55 years worth of accumulation in order to live in an RV, moving from a 1,600 Sq Ft home filled with stuff, including a video

editing room, mechanics tools, teaching gear, 3 vehicles and more. They found online groups to sell much of their stuff and within 5 months

were able to downsize to fit into a RV, addressing the emotional element of getting rid of things that have been kept for years. It's a short

video that provides insight to the process of downsizing.

- Bad Spending Habits Rich People Avoid:

Business Insider (12/2017)

This is just a cute little video of how the rich spend their money, or rather don't spend their money. This goes directly into minimalism. In

their own words, "After studying hundreds of people both rich and poor, author Tom Corley says these are the bad spending habits that rich people always avoid."

If you look at this video, take a look at the recommended or "Up Next" videos that appear on YouTube; you might find that advice on finances interesting as well.

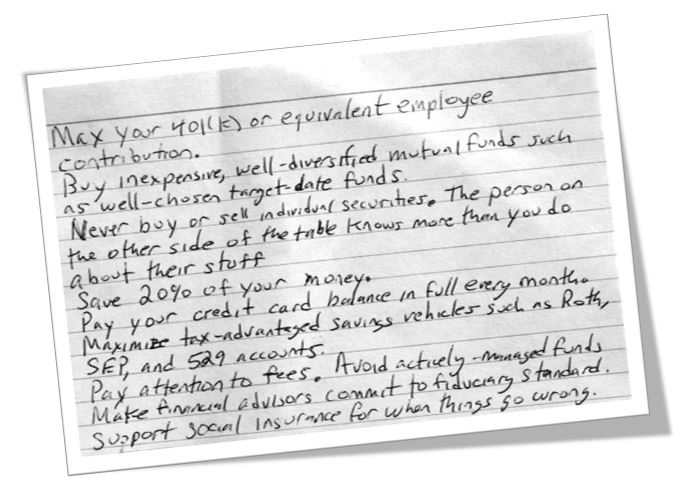

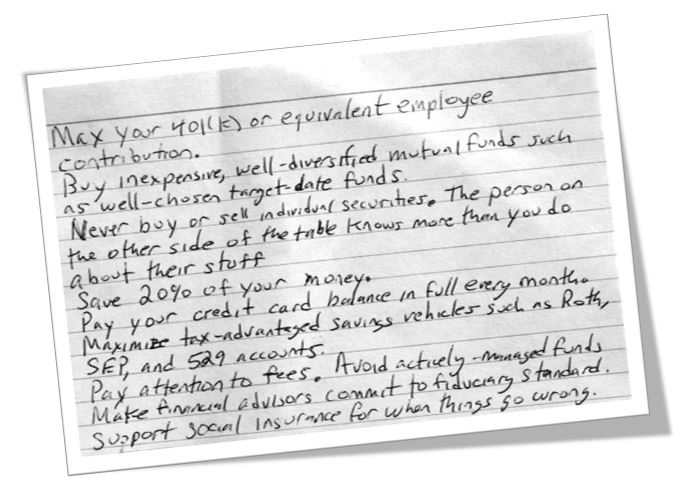

- All the Financial Advice You'll Ever Need Fits on a Single Index Card:

PBS News Hour (04/2016)

This was one of the weekly Making Sense Reports of PBS News Hour. A Professor had a life crisis in 2003 leaving him with a disabled relative to

take care of on top of his own family. He didn't know anything about finance so he dug in and reserached and came up with the basic ideas which

all fit on a 3x5 index card (which is shown below). In 2013 he wrote down the 10 essential items on an index card and posted it online; it went

viral quickly. This turned into a book

The Index Card: Why Personal Finance Doesn't Have to Be Complicated by Helaine Olen and Harold Pollack. The book gives more details

around the 10 items, giving ideas and specifics about each one.

The description says about this report, "At first glance, fiscal planning can seem more complex and time-consuming than it's worth. But according

to Professor Harold Pollack of the University of Chicago, you can fit all the financial advice you'll ever really need on a single index card.

Economics correspondent Paul Solman takes a look at Pollack's ten easy tips for simple and sensible money management."

- Investing Strategies and Sources / 401k:

There's a lot of information out there about how to invest in the stock market or manage/balance your 401k if you happen to have one

(click here for information and history of the 401k).

It's extremely disheartening that many employers and even financial institutions threw employees into the role of trying to manage their 401k's. To help employees

(and also help themselves, more to the point) from calling investment firms to seek out advice on how to allocate their funds, firms have created

Target Date funds that each have a particular date where the individual is expected to retire and the financial firm balances that mix automatically

to go from high risk growth investments (like stocks) for dates far into the future to bonds and other low risk securities as the target date draws closer.

There are many out there, which I will give an example, who really hate target date funds. Although it does help the investor to stick all their dollars

into the fund and forget about it, the investment firm likes it because it can collect fees on the fund while reducing the number of questions their support

center has to field. Having said this, I'm going to include the disclaimer before I provide links to information I have discovered.

If you look at the history of 401ks, it started out as a technical adjustment to the tax code (section 401k) and was intended to impact high-earning

corporate executives using profit-sharing plans. In the old days, with a rare few exceptions remaining today, companies provided pension plans to it's

employees and the employee didn't have to worry about anything; once they retired they would receive a pension that would provide for their care until

death. This often included not only a set of dollars each month but health benefits as well. Once 401k's came along, employers thought they could

shed themselves of the responsibility of providing pensions as a benefit and instead simply match a certain percentage of whatever the employee puts into

the pre-tax 401k retirement account. This took the burden and risk off of them and laid it at the feet of the employee, and that was back in 1978. Some

companies don't provide 401k's, others do provide them but don't have any dollar percentage match (meaning, if I put in 6% to my 401k, they would often match

4% on top of that). Two companies I used to work for provided a high percentage in the 401k without me having to put anything in. For example,

one company I worked for provided 12% of the employee's pay into their 401k each paycheck and also included a partial pension plan on top of that; after the 90's was over they cut the

amount down to 6%, then in the mid-2000's they cut it down to 5% and six years after that they took away the partial pension plan for new employees and started

laying off it's long term workers. The other company I had worked for provided (and still provides today) a combination of giving it's employees 6% into their

401k and matches an additional 4% if the employee puts in 6%; they removed their pension plan in the late 90's and now only provide the 10% total value. Another company

I worked for gave existing employees the option in the late 90's to keep the pension plan or they could roll it over into a 401k, then any new employees

being hired would simply get the 401k option. More recently I worked for a company who only provided a 4% match if you put in 6% (which seems to be the standard).

For non-profit companies many offer a

similar plan called the 403b. When looking for an employer, it may be a good idea to consider their retirement as part of the entire compensation package.

Here's the problem. Once pensions went away and it was incumbent upon the employee to put their own dollars into a 401k, not everyone did it, even if the

employer would match a certain percent. Many would tell me "I'm going to work until I die" and yet they close the door to have the option to retire (hence me

creating this site). Even the people who created and initially pushed the 401k's (in a slate.com article)

now think it was a bad idea. The same article goes on to say "The Center for Retirement Research currently estimates that about 52 percent of households are 'at

risk of not having enough to maintain their living standards in retirement' with 'the outlook for retiring Baby Boomers and Generation Xers far less sanguine than

for current retirees.'" Another article on

CNBC

states "401ks are an especially important retirement tool given that pensions are on the decline and Social Security 'could be insolvent by 2034,' and because

an alarming number of Americans have little to nothing saved for retirement individually: A recent study by GOBankingRates found that 42 percent have less than

$10,000 socked away." If you aren't fortunate to have a 401K or similar employer sponsored plan, you can still invest in a

Traditional IRA or

Roth IRA, each has it's advantages and disadvantages.

I know of one person who quit a company and realized he had a small pension available (under $100K), so he rolled it over to a personal IRA because he did not

trust his former employer to fund the pension properly or that they may raid the pension itself; also, there were restrictions on the pension whereby if he died

50% would go to his spouse and if they both died the dollars would go back to the company. Rolling it over allowed him the option to leave it to heirs in his will.

However, his question was, once it was in the IRA, where does he put the dollars? I've had IRAs and have managed them myself and had paid the investment firm to

manage them and it ended up we did about the same, except they charged me high fees to manage. So if you do it yourself, where to put your money?

You might ask, "What does this have to do with minimalism?" A lot actually. In a Cheap RV Living interview above titled "Young Speech Therapist Living in a 5th Wheel";

that is a young woman named Ashley living in a 5th wheel and stocking a ton of money away in her 401K, she said 70% of her salary. She indicated on the video that

she was making $20 an hour currently (starting out), which puts her at about $42K per year (if she works fulltime), but she takes time off (she took a month off one year).

So figuring taxes and having unpaid time off, we can assume she clears about $33K, which 70% of that is about $23K per year. She said she could retire in 10 years.

Assuming modest increases in pay and promotions and a modest rate of return on investment, 10 years would put her at almost $500,000. If she continues living in a RV,

then that would be sufficient to retire (reference 40 Years a Nomad video from Cheap RV Living

where someone has been a nomad 40 years starting out with only $140K and he says he still has the bulk of it today). If she works an additional 8 years she would have

over a million dollars. So living as a minimalist in an RV and saving so much, she can work half the time other people work and retire for life. If you spend all your

money on housing and a certain lifestyle to have no money to retire on, then you will be forced to live minimalist and work to support even that in your old age. So better

to plan ahead like Ashley has done.

In struggling with where to invest 401k money, I consulted a friend many years ago and that advice has worked pretty well. In 2008 I did have a drop in my 401k, but I

didn't bother with changing anything; I left it alone and it came back and surpassed my expectations. However, there are methods out there to reduce risk in investments

that I've heard from 3 separate sources, so I wanted to share that here. This is just informational for entertainment purposes and what you decided to listen to and use

is totally up to you.

-

Bullet Proof Nest-Egg Advice From Tony Robbins and Ray Dalio. Tony speaks with Steve Forbes about

how to invest money based on Ray Dalio All Weather Portfolio (also known as Risk Parity) where it focuses on asset allocation. He talks about the concept of All Weather Allocation,

something that can work in any market, bull or bear. The concept talks about having balanced risk so people don't lose everything during a market downturn like that in 2008.

In 75 years this concept has been right 85% of the time and in the years where there were losses (like 2008), the biggest loss was 3.95%. The concept counters conventional wisdom,

but they indicate that it has worked well for many years. I suggest your read the comments on this video as well as there are a lot of naysayers. Ray Dalio is the founder and

co-chief investment officer of Bridgewater Associates, the largest hedge fund in the world. Click if you more detailed information on

Ray Dalio's Investing Strategy and Advice.

Another individual who actually uses this strategy and comments on it, click here. The asset allocation mix

in question is (here's the big reveal): Stocks 30% (VTI), Long Term Treasury Bonds 40% (20+ years, TLT), Intermediary Treasury Bonds 15% (7-10 years, IEF), SPDR Gold Trust 7.5% (GLD),

Commodities 7.5% (DBC). If you're in a 401k with limited selections, you can see if there are any funds similar in composition. If you have an IRA or other open market investment

vehicle, you can select these or choose similar ETFs or index mutual funds. Note: This is a volatile topic and many of you may disagree, which is why I suggested reading the

video comments. Investment strategy is right up there with talking about politics or religion.

- The Only Investment Video You'll Ever Need When I talked with a friend of mine who is an

accountant and investor himself he mentioned the topic of leveraging ETFs as part of my investment mix. I then came across this video that explains how to do this in a simple way with only

2 ETFs. He explains it really well and lays it out very simply, and it's a variation on the one above by Tony Robbins and Ray Dalio. Where they have 5 ETFs in their portfolio, Calvin Rose

(creator of this video) says you can use only two and he also used mentioned above, TLT and IEF. He maps out a conservative, moderate and aggressive scenario and shows the rate of return and

drawdown of each. In another video he has, A Better Way to Invest - with just two ETFs or Mutual Funds, he suggests

you can use SPY (SPDR S&P 500 ETF) and AGG (iShares Core U.S. Aggregate Bond ETF) in different percentages based on the risk or drawdown you are willing to tolerate. Calvin also has a video

called I Hate Target Date Funds. He basically shows how the strategies he shows in the previous 2 videos out perform

target date funds with lower risk. In this video he does a comparison with several target date funds. You can watch more of his videos from his site,

Calvin Rose . He hasn't posted a video since 2017 and he has few subscribers, but I found his presentations

to be highly educational.

- An all ETF portfolio: Can it meet your needs?This is a video from Charles Schwab. I included it here because Charles

Schwab is a large investment house and they show how you can have an entire portfolio using just ETFs and they give three different types - ultra simple, middle of the road and fine-tuned, with the

latter being more complex mix. They also give the advantages and disadvantages of each mix.

- The Dave Ramsey Show I'm finishing the 401k/financial topic with this site called The Dave Ramsey Show. His YouTube channel has

almost 800,000 subscribers and he provides sound financial advice. Dave has a website where he tells his story, both in print and in a video.

In his own words from his website, "I formed Ramsey Solutions in 1992 to counsel folks hurting from the results of financial stress. I've paid the 'stupid tax' (mistakes with dollar signs on the end) so hopefully some of you won't have to. I

wrote the book Financial Peace based on all that Sharon [his wife] and I had learned, and I began selling it out of my car. With a friend of mine, I started a local radio call-in show called The Money Game, now nationally syndicated as

The Dave Ramsey Show.". He has tons of videos you can watch for free and covers dozens if not hundreds of topics like paying off debt, loans, taxes, investing, 401k's, ETFs and many more. Dave also advocates getting yourself a

financial advisor. With all of his knowledge, he himself has a financial advisor and explains the benefits of having a good advisor.

I've provided all of this in conjunction with the minimalist movement as well as downsizing (or tiny house/mobile living) as an alternative to start saving money for retirement and

that you don't have to be intimidated by so many investment choices. Again, if you have a 401k, they are usually limited in the number of selections you have and as of late I've seen

about 40% to 50% of those selections are Target Date funds. If you don't want to chance using ETFs or manage your own investments, then I would suggested watching Dave Ramsey's videos and

get yourself a financial advisor. Hopefully you find this information useful and investigate further.

|

I hope you find this information useful. I'm in my early 60's now and one of the amazing things you gain is hindsight. One of the Mission Impossible movies has a song by

Limp Bizkit called Take a Look Around and one of the lines in the song is "And there ain't nothing I can do, 'Cause life is a lesson you'll learn it when your through".

You wouldn't think something so insightful would come from a group called Limp Bizkit, but that line has always stuck with me because it is so true. We live in a big

house that is now hard to afford (thanks to layoffs) and hard to maintain (5 bedrooms, swimming pool, large lot/yard) and we will need to downsize, but now the house is

full of people so downsizing won't work just yet.

With all the money I have made working over the years, had I lived small I could be retired now. My wife and I had a small house at one time, but sold because it was

too small for a growing family and near a busy street. Like many of us, we spend money on useless junk that we think we need and

then spend money storing it only to have our survivors go through it later and throw stuff away, having done so myself with relatives who have passed on. In hindsight,

wouldn't it have been better to live cheaply, even if it's just a small house? Wouldn't it be nice to be debt free and not have to work until

life is almost gone? Perhaps you don't fit into that category; perhaps you made the right decisions and are reaping the rewards of being frugal, thoughtful and disciplined.

I look at Ariel of Fy Nyth above and how smart she is for someone so young. Even the baby boomers who are now either retired or thinking of it are downsizing and heading

out living life by getting a house on wheels and doing things they thought they would never be able to do because they were tied down by stuff.

If you are younger and not sure what to do, if you haven't collected a bunch of material things to weigh you down, if you don't have the money to get into a house or even afford

a decent apartment (my kid's friends often live in unsavory apartments), if the future looks bleak because things cost too much, there is a movement out there people are

flocking to in droves. Like Tinyhouse Prepper who lost 4 houses and had only a few thousand dollars after all was said and done, they found a new life in a 35' travel trailer where

he and his wife are debt free, happy and he has now retired and looking forward to the future. They have no plans to go back to a regular, expensive house. Maybe you can just

try it out like A Guy, A Girl and A Campervan and live that way while you bank all your money to buy something better, sooner - which is how they bought their cabin. Maybe you

try it out and discover you actually love it and you only have to work 6 months out of the year and can travel and see the world the rest of the time, or see the world while you

work. Maybe your retirement dollars that wouldn't pay for the house payment, let alone food, clothes, utilities, can now be used to pay for a house on wheels that leaves you

with money in the bank each month. Maybe your stess is reduced and you can relax and enjoy life and head to Arizona in the winter and New Mexico in the summer like many

of the nomads do - like the 2nd of Bob's videos above, Solo Woman Joyfully living in a Class C, does. She buys the inexpensive New Mexico Parks Pass and spends half a year

traveling the 35 state parks near beautiful lakes, mountains and deserts. His most recent video as of this time (2/9/2018) is Granny Lives in a VAN of this 69 year old woman who bought a Class B van for $1,000 and put $1,500 in upgrades. She's been on the road for 4 months now and

loves it and is planning to get the NM Parks Pass ($225 for out of state, $100 for residents) and living in NM for the summers. Maybe RV's and tiny homes don't appeal to you,

but you could swing downsizing to a small house or condo that requires less maintenance and money. One YouTube couple I didn't mention above is

Gone With the Wynn's who spent years traveling in Class A motor homes until recently where

they are living on a boat traveling the oceans (their About Us video is amazing and inspiring).

There's nothing that says we have to follow what everyone else does (although, it's funny that so many are becoming nomadic and you'd be following them); but nothing that says

we have to live in a big house with a white picket fence and a swimming pool with two new cars in the garage and a lush green lawn out front. There's nothing that says we have

to take on an 8-5 job or, as I've experienced before, a job that requires 10, 12 or more hours per day and often weekends to achieve corporate goals that will mean very little

on your death bed, or perhaps mean very little right now. The one thing I know is that it's better to learn the lesson before life is through. It's better to learn it before

you are nearing a retirement you may not be able to take, or be forced to live that way because all your money went to houses, cars and things and left you with nothing. There

was one video by Bob Wells of Cheap RV Living where he introduced a new 12 part series on how to live rent free and he talks about this topic very clearly. He explains how people are living only on social security and not having enough, or don't make enough money to pay all their bills, so he shows us

how to live a great life cheaply. Just a side note, several of the nomads who have found happiness living

the life they have now critize Bob Well's for telling others about it because it will get too crowded, swamped and mess things up for them. He addresses this concern in a video

The End of the World - Ehrenberg is Being Enforced.

Ehrenberg, AZ is a place where many noamds, RVers and snowbirds go in the winter to live for about 6 or so months. Prior to December 2017, anyone could stay all

the time with no BLM (Bureau of Land Management) interference as the policy for BLM land is that you can stay only 14 days and then have to move 50 miles (or so, varies) and stay

there 14 days. The overall intent is that it's a recreational and camping area, not a place to move in forever or for months and years, and it's a shared resource for all the public.

In the End of the World video link above Bob addresses this concern, saying he will continue to share this information with others to help them out and that there is so much land and so many different places around Ehrenberg that it should not be an issue.

Most people are not like Ariel of Fy Nyth. Most have to learn lessons the hard way. They don't learn from reading or watching or from lessons of those who have gone before.

In my career I've created a lot of documentation and training materials that I later learned were never looked at again, or in those rare cases a few individuals did read through to learn

something and not have to guess. Most people don't read instructions, don't listen to elders or experts, don't take the time to understand. Our culture is filled with people who are

prideful, stubborn and feel they know more than anyone so no one else has anything of value to bring to them. This is true for many younger people, but it's in most everyone.

It's a cycle. They will get old, learn lessons the hard way and end up trying to tell their children what they learned only to be told "no thanks". What's nice about our

Internet generation is that information and lessons are so widely available and free. Although you have to be mindful that there is some bad and incorrect content out

there, you can find a lot of good information online. To drive the point home, I'm going to list a few YouTube videos below that should be a wakeup call for people, especially

those just starting out. Know how some people ended up may help you to avoid the mistakes they made.

- The Death Of The American Middle Class (2011):

This is a short documentary showing how middle class in America has been dissolving over the years. There are individuals out there, like

Ben Shapiro, who disagree that the

middle class has been reducing over time, but there's enough stories out there to show people have been negatively impacted. The popularity of layoffs from corporations and

jobs going over seas (my own job went to India in 2016), people who once made decent incomes have to settle for lower pay just to stay afloat (a reality that I and many of my

former co-workers who were laid off are facing now). Just for definition, "Pew Research says the middle class runs from $42,000 to $125,000 (before tax). They define middle as

a household of three with an income that falls between two-thirds and double the median income." The

Pew Research study

shows the middle class is shrinking because some are becoming more wealthy (earning above $125,000) while others are falling below $42,000; their assessment is that

"With around 120,000 people declared bankrupt each month, many of the squeezed middle-class see the American dream slipping away. The national trend is clear - the middle

class is losing ground as a share of the population, and its share of aggregate U.S. household income is also declining." In regard

to this video, Death of the Middle Class, "Our national myth is changing", explains author and journalist Thomas Hartmann. "Whereas hard work was once seen as the route

to prosperity, nowadays the best most people can hope for is a lottery win. Three generations of farmers in Vermont ring the changes of the past fifty years."

- A Cluttered Life: Middle-Class Abundance:

I've included this video because it showcases that for those of us who are or were in the middle class often spend money on things that become clutter. Since one of the trends,

and one that is required for tiny or mobile living, is to reduce "stuff", it seems appropriate to point out all the junk we as a society collect and save; that's why there are

TV shows like "Hoarders". For this video, "Follow a team of UCLA anthropologists as they venture into the stuffed-to-capacity homes of dual income, middle-class American families

in order to truly understand the food, toys, and clutter that fill them."

- ABC's 20/20 - My Reality: A Hidden America:

A 20/20 Documentary that shows families considered middle class who have been strugling and living paycheck to paycheck.

- PBS Frontline: Inside the Meltdown:

This is one of the documentaries on what happened that led up to the 2008 financial meltdown. This documentary investigates the causes of the worst financial crisis in

70 years. This meltdown is what triggered Tinyhouse Prepper to lose 4 houses and find alternative living in a 35' travel trailer and ingrain in them the will to never

get in debt again. This is similar to how our grandparents (or great grandparents in some cases) lived life after the crash of 1929.

- Wal-Mart: The High Cost of Low Price:

I almost didn't include this because it is controversial. Wal-Mart is often the one store that has low prices that helps Americans, but it comes at a cost as well.

"Everyone has seen Wal-Mart's lavish television commercials, but have you ever wondered why Wal-Mart spends so much money trying to convince you it cares about your family,

your community, and even its own employees? What is it hiding? Wal-Mart: The High Cost of Low Price takes you behind the glitz and into the real lives of workers and their

families, business owners and their communities, in an extraordinary journey that will challenge the way you think, feel... and shop." However, I should mention that

Wal-Mart has been the friend to nomads in that they allow nomand's to spend a night or two in their parking lot all across the United States.

So, if you find this information useful and it sparks a fire or a thought that you consider, then that's awesome. I hope you find it worthwhile or, at least, if you ever find

youself in a situation where you can't afford to live, you remember this and know there are alternatives.

I've come across many other good channels that I would like to include here. These are one's that stand out and have really good content that you might find useful

as well as entertaining. They range from large channels with almost 1M subscribers down to one that has less than 400, but all have really great videos.

Walden: This is the free audiobook of Walden by Henry David Thoreau (1854). Many of the people

above mention reading Walden and how it

had a profound impact on their decision to live simply and mobile. "The book describes two years of his life living alone at Walden Pond

in Massachusetts. He recounts his daily life in the woods and celebrates nature and the individual's ability to live independently of society."

Kirsten Dirksen: Kirsten has as of this time almost 800,000 subscribers.

Her videos are awesome. They are "about simple living, self-sufficiency, small (and tiny) homes, backyard gardens (and livestock), alternative transport, DIY, craftsmanship and

philosophies of life.

Living Big In A Tiny House: This is actually a very popular channel

with almost 900K subscribers. This guy focuses on tiny homes, downsized designs and sustainable living and the videos are incredible. Bryce says "Join me on my travels as I journey to

find the very best tiny homes, alternative dwellings and stories of downsized, eco-friendly living. I'm not just watching from the side-lines though! I also get stuck in with my own small

space builds."

We're the Russos: A great 80K subscriber channel of a couple who live in

a campervan with their awesome dog. "We're Joe and Kait. We travel full time in a van and share our journey and what life is like living in a van. Currently, we produce a weekly travel

series about camper van life published every Wednesday. Our Class B RV is a Hymer Aktiv 2.0 based on the Ram ProMaster chassis."

Dylan Magaster: Dylan Magaster lives in a Chevy G20 van and does wonderful videos. In

his own words, "A digital nomad and filmmaker, Dylan has been making documentaries about the people he meets along his journey, focusing on alternative living environments.

He's made films about converted vans, tiny homes, off-grid homes, even a home made from a jetliner in the woods of Oregon."

Dan & Jen Nevada: This small channel just went over 5,000 subscribers;

a couple who live in their Class A motorhome. Their videos are well done and informative, and their interaction with one another is very entertaining. They say "we retired early and

kicked our two boys out of the house...we mean, raised them to be self-sufficient, productive members of society. Our plan was to travel and explore our little part of the world but that's

all changed. [We bought] a motorhome and hit the road full time at the end of 2017. We're taking you along for the ride. We post on Mondays, Wednesdays and/or Fridays."

Long Long Honeymoon: This is a very small channel now but they have

some really great videos. "Long Long Honeymoon ('Loloho') celebrates travel and outdoor adventure. Sometimes we tote an Airstream (RV) travel trailer; sometimes a backpack.

[We have] RV camping tips & tutorials, International travel tips & tutorials, Gear and product reviews, Airstream specific tips, Travelogues and [even] cats playing piano."

RV Joey: A young woman with her dog and 8K subscribers, she travels

in her Class C RV with a caravan of friends.

Bex Cat-herder: Another woman with her cute little dog and also 8.5K

subscribers, she travels in her 13' Scamp trailer. She produces some really nice videos and footage as she shares her journey. She has had to endure some really tough situations and yet

she has come out of them very well, from getting her car and all her computer and camera equipment robbed from her in San Francisco to have her trailer fall apart while she was stopped at a

stop sign.

Average Alice: This is a very small channel, less than 400 subscribers,

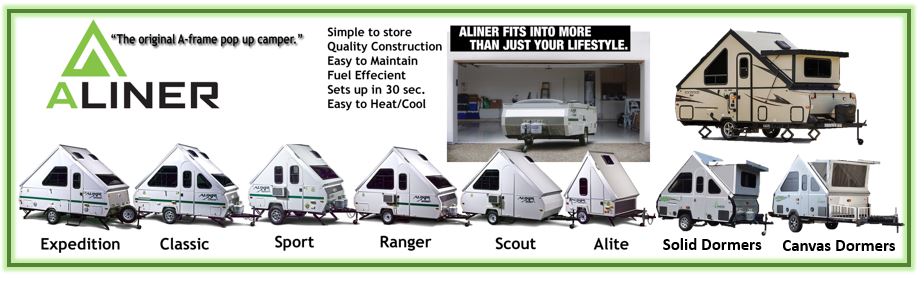

but I really like her videos. Her and her husband travel in an "Aliner LXE 2018 with double dormers and cassette toilet/shower and cool cat A/C, hauling with a Toyota 4Runner TRD off road premium,

2017, with all terrain tires added."

Live and Give 4x4:A couple out on the road in a very unique 4x4, they give

a unique perspective as they travel around and video their adventures."

Ultramobility: This channel specializes in Campervan Reviews.

"Ultramobility is all about the mobile lifestyle: living, working and traveling in your class b camper van. I review RVs, do head to head comparisons, give buying advice and answer

viewer questions weekly. Check out all my playlists covering everything about camper vans and tune in to my weekly Live Stream. I love the idea of a small, self-contained home of

wheels. I own a 2017 Pleasure Way Ascent that I use primarily as a mobile office and weekender.

Princess Craft: An RV deal who produces some really detailed,

wonderfully produced videos of different RV's they sell. "We've been a RV Dealer in Texas since 1968 and are located in Round Rock, Texas, just 25 minutes north of Austin. Princess

Craft Campers specializes in the sale of truck campers and lightweight trailers. And when it comes to Lance Truck Campers, the #1 Selling Truck Camper in America, we are the industry experts."

Workamper News: Jobs and Information for RVers. "Workamper News

is here to help you learn about and live the Workamping lifestyle successfully! Not only can we help you find, research, and apply for RVing jobs all across

America, but you can also learn about getting started with the RV lifestyle itself."

|

I should also include the dark side (or perhaps the unwilling side) of tiny house and mobile living. You see it in news reports and headlines about the all time high of

homelessness and the decline of the middle class, as some of the videos above depicted. If you watched the Without Bound - Perspectives on Mobile Living documentary above,

you heard Bob Wells state that someone living in a van (or car, RV, whatever) is not homeless if they choose to do so, but someone who is forced to do so is homeless. In the United

States today millions have been left with little option other than to live in hotels, with relatives, in RVs, vans, cars, tents, shelters and some just out in the open. You simply

go to YouTube and search "mobile living" and you see the gambit of lifestyles, those who love and choose to live a mobile or small lifestyle and those that have no choice; one

video I saw come up on the first few selections was "The Mobile Homeless". If you Google just the word homeless you'd find tons of statistics and information and how it's gotten worse over the years, especially in California. In December 2017 the New York Times reported "More than one-quarter of the total homeless population nationwide lives in California, roughly 114,000...[and] about 1.6 million

households are considered to be living in 'worse scenarios'...living with low-wages and spending more than half of their income on housing. That number has ballooned

continuously through much of the last decade, while wages have remained flat."

Many of the videos you find on the YouTube sites above will have stories of people who were forced to live tiny and/or mobile, only to find that they love it or at least

enjoy it very much. They are able to save all that money that is not going for housing for the first time and they may not work as much, if there is a need to work at all.

Not everyone falls into this category, of course. Which is why I am going to include a few videos below that show quite well the situation many find themselves.

I'm only including a few links; there's so many more that you will see recommended or referenced when you go to those. For some it comes down to attitude, for others

they can not even afford to have a RV or camper and have to make due with what they have or what others will provide to them. One of the issues that stop people from

even considering living in something small like a van or RV, or even a mobile home with many bedrooms, is the stigma we as a society have attached to people who live

this way. Even Tinyhouse Prepper has a video talking about how they are not homeless, but several

YouTube trolls have called them homeless or other phrases because they

live in a trailer. Perhaps in the end it does come down to attitude; is the glass half full or half empty? Am I cursed for not having my nice home or blessed to

have a roof over my head?

One last thought...the majority of these people in the next few videos probably never even envisioned themselves in the situation of being "homeless" or losing so much

they had worked for in their life. In the Our Story video of Tinyhouse Prepper linked above, she makes the statement that we are taught if we work hard and try to get

ahead we will have a good life in the end, but it doesn't always work out that way. In fact, lately, in most relatives and friends I know, it's not that way at all.

That's why I have the Oblivion prepper page, and why I have created this list. The tiny house or mobile

living life may not appeal to you whatsoever, and that's fine; I love living in a nice house myself. But at least it's good to know there are alternatives and know

"how to" do it the right way before finding out the hard way.

- 60 Minutes - Hard Times Generation: Families Living in Cars:

(Nov 2011) Scott Pelley brings "60 Minutes" cameras back to central Florida to document another form of family homelessness: kids and their parents forced to live in cars.

This video is from 2011 and the unemployment rate back then was extremely high; in 2009 it was 10%, by 2011 it went down to 9% and by March 2018 it was at 4%. So it

has been getting better, but even if people go back to work, the time spent with no job has left many struggling financially. However, that's the U-3 unemployment rate

(called the "official rate") that does not take into consideration many other factors like low paying jobs, part time jobs, long time unemployment and more. Based on the more accurate

U-6 rate, the 2009 unemployment rate was just over 17%, 2011 it went down to 15% and

March 2018 the value is 8%.

- How the Mortgage Crisis Forced Thousands of Americans to Live in Their Vans:

Mortgage crisis forces thousands of Americans out of their homes with little to no money or options left open to them. Even though the title says vans, it shows people

living in cars, RVs and other options.

- End of RV Living: Why You Shouldn't Go Nomadic:

This video from Tami's Nomadic RV Life Channel is from a female RV nomad's

perspective. She talks about the dangers and threats of being on the road, sometimes all alone. She talks about having to deal with a stalker as well as someone

who slashed her tire. In other videos on her channel she gets into dealing with all the temperature variations and having to deal with snakes, spiders, centipedes,

scorpions, mice/rats and larger preditors such as bears, coyotes, etc.

- 10 Harsh Realities of RV LIFE:

"Join us (His and Hers VLOGS) for a Studio Session about 10 Harsh Realities of RV LIFE. Topics include; camping, Quartzsite, weather, laundry, buying a RV, and dealing with

rodents." This video showcases a couple who have lived in their RV for 2 years and have developed a list of things that mobile dwellers have to deal with.

- The Hard Cold Reality Of Being A Nomad:

This is a video from Little House on the Road,

a small YouTube Channel of a couple who (until recently) lived in a popup camper. In April 2018 someone burned down their popup camper in a national

forest while they were away; they ended up building their own "cab over", a truck bed camper he made from wood for about $600. In their own words,

"After years of working 60 to 70 hours a week and never taking a vacation, Carolyn and I decided to quit our job and begin our full time RV'ing.

We bought a 1970 Starcraft pop-up camper and fixed it up. We may buy something more substantial later but we are quite excited starting our

adventure in this pop-up. [However] sometime you just run into scary people living as a nomad." Just like when you have an awful

neighbor while living in a regular house, you can have someone at the same camping area who are troublesome. Most of his videos are what I would call negative,

but he would term as realistic. Just looking at the glaring video titles in a stark red and yellow font, a sample of titles are "Scary!, Fail!, Bad Idea,

Hate This, Not Enough Money, Now What, Terrible Day, Lie" and more like that. They run into a lot of sutations others have not, so they do give a great

perspective of the pitfalls you can expect while living on the road.

- An unsuccessful story - from Millionaire to Homeless:

And this is a story about a man who was a millionaire in Great Britain and who is now a homeless living in a caravan somewhere in Lisbon, Portugal without money and family.

Comunidade Vida e Paz is a nonprofit organization in Portugal dedicated to providing the poor and homeless of Lisbon with nutritious meals, clothing, and assistance in the

transition to employment and life off the streets.

- Colorado Is Forcing Off-Gridders Back on the Grid, Bans Camping On Private Land:

"Throughout the country, local zoning officials have made it impossible for people to go off the grid, in many cases even threatening them with jail time for not hooking

into local utilities. Because of zoning laws that target the off-grid lifestyle, many off-gridders have moved to areas in the Southwestern United States to escape

overzealous zoning officials. But this week, off- gridders were dealt another blow in an area of the country that has become a magnet for people looking to live

a more self-reliant lifestyle. Costilla County, CO Bans camping on your own Land; Zoning Officials attempt to make people hook back into the grid."

Updated December 31, 2023

01/01/2024 - Added video on the potential downside of Multigenerational Living.

12/31/2023 - Added Multigenerational Living section, updated intro at top, removed Canadian RV Life as channel went away, Update and New content.

08/20/2022 - Removed a bad link, made some minor edits, added 1 new Video under Cheap RV Living entries.

08/14/2022 - Added 3 new channels, 10 new videos and 4 updates to existing channels (the words new and update are next to the titles).

05/30/2022 - Added 2 new videos to Cheap RV Living, updated content and info for many items as channels have grown and changed over time.

02/28/2020 - Added video Solo Female Living 3 Years in a Ram Promaster, updated Tinyhouse Prepper info and added content, fixed navigation links.

06/01/2019 - Added CBS Sunday Morning banner link featuring Bob Well's interview, added many Jobs for Nomads links, made content full justify.

05/27/2019 - Added Bob Wells new video, updated Caravan Carolyn and Starry Hilder's channel descriptions, updated Towing Guide link to 2019, added advertisement for Stratagems book.

10/26/2018 - Added Dave Ramsey's show, link and info to financial (minimalism) section.

10/19/2018 - Added a new Bob Well's video, Justin and Kirsten's Skoolie (with 5 Kids); added NBC News link for dental in Los Algodones.

10/14/2018 - Added "Investing Strategies and Sources / 401k" to the Minimalist section.

09/23/2018 - Moved Caravan Carolyn's channel from Honorable Mentions to the main selection and expanded the description. Wonderful channel.

08/19/2018 - Added video link to the Dark Side topic, Tami's Nomadic RV Life, expanded Little House on the Road info below her link.

08/12/2018 - Added entire section, YouTube Honorable Mentions. Updated Tinyhouse Prepper description to clarify and expand on their situation.

07/20/2018 - Added video near the top "What if the crash of '08 had never happened?" from Tinyhouse Prepper.

07/13/2018 - Added additional information and content to "Going to the dentist in Los Algodones, Mexico" section; added a video from

Canadian RV LIfe, RV West Article; added Note below Slim Potatoheads section about an Aliner with shower and toilet.

|

|